Payments powering Europe's vision for a single digital market

The European payments landscape is set to change profoundly over the next 6 years', as the European Commission lays the foundations for a single digital economy.

The European Commission considers its strategy for a ‘Digital Decade’ to be critical for the EU's future prosperity and that achieving the EU's Digital Decade agenda can potentially unlock over 2.8 trillion euros in economic value (i.e. equivalent to 21% of the EU's current economy). At its heart, the strategy sets out to deliver a single digital market, where residents, citizens, businesses and governments can seamlessly and safely engage in commerce and digital services without prejudice.

Europe recognises the importance of a sovereign, resilient and competitive pan-European payments market!

In recent years’, the European Parliament (EP) has actively progressed its agenda for implementing innovative, competitive, secure, resilient payment services for consumers and businesses across Europe. For instance, PSD (2007), SEPA (2008), Multi-lateral interchange fee (2015), PSD2 (2016), PSD2 RTS CSC & SCA (2018 onwards) have each been implemented over the course of the past 15 years’. Further, the EC has ensured the implementation of instant retail payments infrastructure. In that period, retail payments experienced prolific growth with electronic payments out-performing cash, alternative forms of payment growing in popularity, mobile payments and digital wallets becoming normalised and soft-POS solutions enabling small businesses to easily accept payments. Further still, the payment services market has become highly competitive - Big Tech and FinTech firms entering the market to deliver new and innovative forms of payment under eMoney and PSD2 licenses.

Yet, Europe remains a fragmented payments market and there are barriers to achieving a single digital economy. For example, Europe has failed to implement a pan-European SEPA payment method for use across the single market and beyond, thus creating reliance on global payment methods. Instead, many member states have implemented local domestic payment methods which are limited to use in local markets. Consumers and businesses remain reliant on global payment providers (i.e. international card schemes) to make payments across the single market and outside of Europe.

Europe is acting quickly to legislate its way toward the necessary improvements and reform!

The European Central Bank and Eurosystem retail payments strategy (updated in November 2023) remarks on the risks of over dependence on non-European payment solutions and technologies – not least, protection of data, traceability in the fight against money laundering and financial crime and competition concerns. The ECB and Eurosystem strategy stress the importance of sovereign, resilient and competitive payment infrastructure and services. The strategy reinforces the importance of the Digital Euro and the likes of the European Payments Initiative. The strategy, emphasises the need for sovereign European payment methods that can enable consumers and businesses to make and receive payments across the single market, but also between international markets beyond Europe (in the future). It is apparent that Europe intends on facilitating the provision of sovereign payment methods which can initially compliment, but potentially replace non-European international payment methods over the longer term.

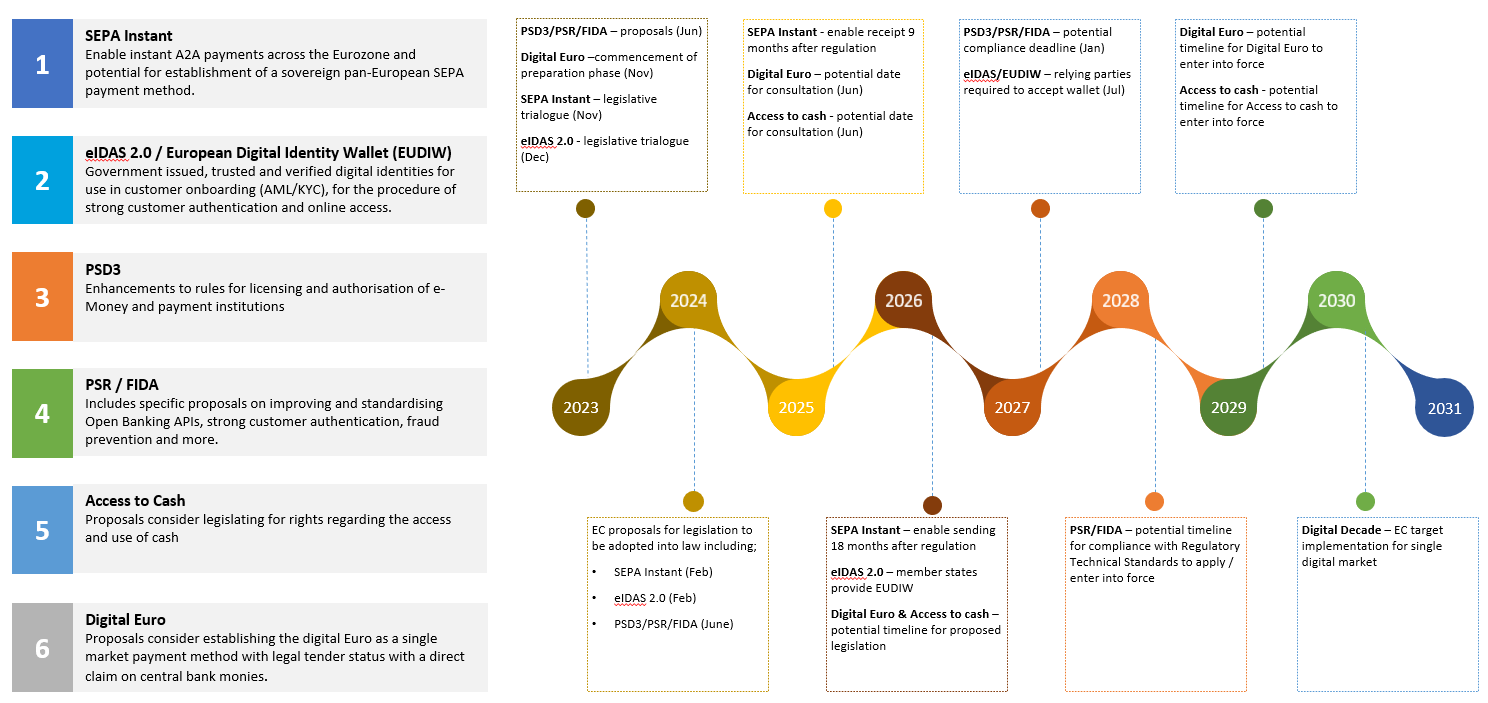

It is clear the EC has mandate to implement a single digital market by 2030 and it intends to continue legislating its way toward achieving its goals. For example, The EC have drafted legislative proposals (Figure 1) for; SEPA Instant Payments, Payment Services Directive 3, Payment Services Regulation, Financial Data Access, eiDAS 2.0, Access to Cash and a Digital Euro. Each of these legislative changes will have a significant impact on financial service providers, consumers and businesses who rely on payment services in their daily lives.

How should you respond?

It is clear the European Payments landscape will profoundly change between now and 2030. Payment firms should not wait for regulatory proposals to be approved - proposed texts are unlikely to materially change. Instead, Payment firms should actively engage in industry discussions to understand the implications of the regulation, but more importantly to form a view on how to respond and the impact on future business strategy and customer value propositions. So how should you respond?

- Don’t wait, act now!

- Understand Europe’s vision for a single digital market.

- Analyse the scope and requirements of each legislative proposal / text and determine its applicability to your business.

- Assess your business strategy, considering likely future scenarios for the evolving payments landscape.

- Identify crossover between the legislation's applicable to your business.

- Design programmes of change and build investment cases for approval.

- Mobilise change programmes and deliver, deliver and deliver!

Over the coming months, I plan to publish a series of articles regarding the changes proposed by the EC. The articles will address the key changes and outline my thoughts on the impacts. My hope is to build awareness, open discourse on the key issues, hear how my industry network is responding and thinking about the unfolding landscape and help where I can. Please feel free to reach out for an initial discussion.

About the author

I am an enthusiastic payments professional with 18 years’ experience supporting businesses adapt their organisations in response to a rapidly changing payments landscape. I started my payments journey with Ryanair plc, supporting Europe’s largest low-cost airline to streamline its payment acceptance services across multi-gateway and acquiring bank relationships. For 5 years’ I was head of programmes and change management with AIB Merchant Services, a joint-venture between AIB Bank and First Data (latterly Fiserv). For the past 8 years, I have worked as a Deloitte management consultant and supporting Deloitte clients address their most pressing payments challenges. I consider myself as privileged to have had the opportunity to learn, contribute to the learning of colleagues and clients on all matters payments.

Figure 1 – Major change and reforms under consideration or proposed by the EC. Note, timelines indicative and to be confirmed by EC.